Cryptocurrency has emerged as a lucrative avenue for wealth generation, offering numerous opportunities for traders of all levels. There are different strategies you can employ to make money with cryptocurrencies. But in this comprehensive guide, we’ll discuss the 12 best strategies to make money with cryptocurrency in 2024. Whether you’re a novice or an experienced investor, these strategies are proven pathways to financial success in the digital assets economy.

How to Start Making Money with Crypto?

To embark on your journey of cryptocurrency wealth creation, it’s imperative to begin with thorough research. Understand the various types of cryptocurrencies, different methods of earning money with crypto, and the associated risks. Following this, secure a reliable storage solution for your digital assets, whether through hardware wallets, software wallets, or reputable online exchanges.

Here’s a detailed breakdown of the essential steps to start your crypto wealth creation journey:

-

Research Cryptocurrency Basics

Before diving into the world of cryptocurrency investments, take the time to educate yourself about the fundamental concepts and principles. Familiarize yourself with key terms such as blockchain, decentralized finance (DeFi), consensus mechanisms, and tokenomics. Understanding these basics will provide you with a solid framework for navigating the crypto landscape.

-

Explore Earning Opportunities

Cryptocurrency offers a myriad of earning opportunities beyond traditional investment strategies. Research different methods of earning money with crypto, such as mining, staking, trading, lending, and participating in decentralized finance (DeFi) protocols. Each method comes with its own set of risks and rewards, so it’s essential to evaluate which strategies align with your goals and risk tolerance.

-

Choose a Secure Storage Solution

Once you’ve decided to invest in cryptocurrencies, prioritize the security of your digital assets by choosing a reliable storage solution. Options include hardware wallets, software wallets (desktop or mobile), and reputable online exchanges. Hardware wallets, such as Ledger or Trezor, offer offline storage and are considered one of the safest options for storing large amounts of cryptocurrency.

-

Practice Risk Management

Cryptocurrency investments come with inherent risks, including price volatility, regulatory uncertainty, and security vulnerabilities. Mitigate these risks by diversifying your investment portfolio, allocating only a portion of your capital to cryptocurrencies, and staying informed about market trends and developments. Additionally, consider implementing security measures such as two-factor authentication (2FA) and keeping your private keys offline.

-

Stay Informed and Adapt

The cryptocurrency market is dynamic and constantly evolving, with new projects, technologies, and trends emerging regularly. Stay informed by following reputable crypto news sources, participating in online communities, and networking with fellow enthusiasts. Be open to learning and adapting your strategies based on market conditions and changing regulatory landscapes.

12 Proven Ways to Making Money with Crypto

-

Mining

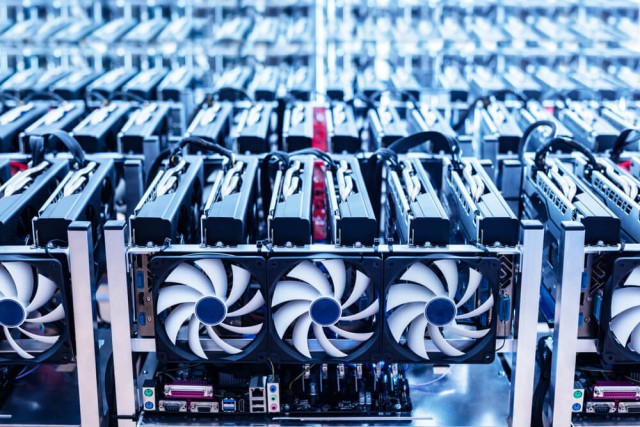

Mining stands as one of the earliest and most fundamental methods for earning cryptocurrency rewards. It involves the process of validating transactions on a blockchain network and adding them to the distributed ledger. Miners play a crucial role in maintaining the integrity and security of the blockchain by verifying and securing transactions. However, mining demands significant electricity consumption and diligent research to ensure profitability.

In the mining process, miners compete to solve complex mathematical puzzles using computational power. The first miner to solve the puzzle and validate a block of transactions is rewarded with newly minted cryptocurrency coins as well as transaction fees. This process is known as proof-of-work (PoW) consensus mechanism and is utilized by many prominent cryptocurrencies such as Bitcoin and Ethereum.

Types of Crypto Mining

- Hardware Mining: Traditional hardware mining involves the use of specialized equipment, such as ASIC (Application-Specific Integrated Circuit) miners, designed specifically for mining cryptocurrencies. These devices are optimized for high computational power and energy efficiency, allowing miners to compete in the network and validate transactions.

- Cloud Mining: Alternatively, cloud mining services offer a convenient way for individuals to participate in mining without owning or managing physical hardware. Cloud mining providers offer mining contracts, allowing users to lease a portion of their mining capacity and receive a share of the rewards generated. While cloud mining eliminates the need for upfront hardware investment and maintenance, it often comes with higher fees and lower profitability compared to hardware mining.

Challenges and Considerations

- Electricity Consumption: One of the primary challenges of mining is the substantial electricity consumption required to power mining rigs. The energy-intensive nature of mining operations has raised concerns about environmental sustainability and carbon footprint.

- Profitability and ROI: Mining profitability depends on various factors such as the cryptocurrency’s price, mining difficulty, electricity costs, and hardware efficiency. Miners must carefully assess these factors and conduct thorough research to determine the potential return on investment (ROI) before committing resources to mining operations.

- Mining Pools: To increase their chances of earning rewards, many miners join mining pools, where participants combine their computational resources to collectively mine blocks and share the rewards. Mining pools distribute rewards based on each miner’s contribution, providing a more consistent income stream compared to solo mining.

2. Staking

Crypto staking involves holding a certain amount of coins in your wallet for a designated period, earning interest as a reward. This passive income strategy offers varying rewards depending on the staked cryptocurrency and the duration of investment.

Staking operates on the principle of proof-of-stake (PoS), an alternative consensus mechanism to proof-of-work (PoW). In a PoS system, validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. This ensures that validators have a vested interest in maintaining the network’s integrity and are rewarded for their contributions.

Key Components of Staking

- Staking Wallet: To participate in staking, investors must hold their cryptocurrency tokens in a compatible staking wallet. These wallets are specifically designed to support staking functionalities and often offer user-friendly interfaces for managing staked assets.

- Minimum Staking Requirements: Many PoS networks impose minimum staking requirements, specifying the minimum amount of cryptocurrency tokens that must be held in a wallet to qualify as a validator. Higher staking amounts typically yield higher rewards and increase the likelihood of being chosen as a validator.

- Staking Period and Rewards: Staking rewards are distributed to validators based on the duration of their staking commitment and the amount of tokens staked. Longer staking periods and higher staking amounts typically result in higher rewards. Staking rewards can be distributed in the form of additional cryptocurrency tokens, transaction fees, or network incentives.

3. Trading

Cryptocurrency trading involves the buying and selling of digital assets on various online platforms known as exchanges. Traders aim to profit from price fluctuations by executing well-timed trades. Either by purchasing assets at a lower price and selling them at a higher price (long position) or selling assets at a higher price and buying them back at a lower price (short position).

While potentially lucrative, trading carries inherent risks and requires a solid understanding of market dynamics.

Risks and Challenges

- Volatility: Cryptocurrency markets are known for their high volatility, with prices often experiencing rapid fluctuations within short timeframes. While volatility presents opportunities for profit, it also increases the risk of significant losses if trades are not executed carefully.

- Leverage and Margin Trading: Some exchanges offer leverage and margin trading options, allowing traders to amplify their trading positions with borrowed funds. While leverage can magnify profits, it also amplifies losses, and traders must exercise caution when using leverage to avoid liquidation.

- Psychological Factors: Trading psychology plays a significant role in determining a trader’s success. Emotions such as fear, greed, and FOMO (fear of missing out) can cloud judgment and lead to impulsive trading decisions. Maintaining discipline, emotional control, and a rational mindset is crucial for long-term trading success.

4. Investing

Cryptocurrency investing involves allocating capital to crypto assets with the expectation of generating returns over the long term. Unlike trading, which focuses on short-term price movements, investing emphasizes fundamental analysis, project evaluation, and portfolio diversification to capture value appreciation over time.

Key Principles of Cryptocurrency Investing

- Research and Due Diligence: Successful investing begins with thorough research and due diligence to understand the fundamentals of individual cryptocurrencies or crypto index funds. Investors should evaluate factors such as project whitepapers, team expertise, technology innovation, community engagement, and market potential before making investment decisions.

- Portfolio Diversification: Diversification is a fundamental principle of investing aimed at reducing risk and optimizing returns. Investors should diversify their cryptocurrency holdings across multiple assets or index funds to mitigate the impact of volatility and potential losses from individual investments.

- Long-Term Perspective: Cryptocurrency investing requires a long-term perspective and patience to weather market fluctuations and realize substantial returns over time. By focusing on the underlying value proposition of investments and avoiding short-term speculation, investors can position themselves for long-term wealth accumulation.

Investment Strategies

- HODLing (Hold On for Dear Life): HODLing refers to the strategy of holding onto cryptocurrency assets for an extended period, regardless of short-term price fluctuations. This approach is based on the belief in the long-term growth potential of digital assets and aims to capitalize on value appreciation over time.

- Dollar-Cost Averaging (DCA): DCA involves regularly investing a fixed amount of capital into cryptocurrency assets at predetermined intervals, regardless of market conditions. This strategy helps smooth out price volatility and allows investors to accumulate assets at an average cost over time.

- Index Fund Investing: Investing in cryptocurrency index funds offers a passive and diversified approach to exposure to the digital asset market. Index funds track the performance of a basket of cryptocurrencies, providing investors with broad market exposure and risk mitigation through diversification.

Risks and Considerations

- Volatility: Cryptocurrency markets are highly volatile, with prices subject to rapid and unpredictable fluctuations. Investors should be prepared for price volatility and adopt risk management strategies to mitigate potential losses.

- Regulatory Uncertainty: Regulatory uncertainty remains a significant risk factor in the cryptocurrency space, with evolving regulations impacting market sentiment and investment opportunities. Investors should stay informed about regulatory developments and assess the potential impact on their investment strategies.

- Security Risks: Security risks such as hacking attacks, exchange breaches, and wallet vulnerabilities pose threats to cryptocurrency investments. Investors should prioritize security measures such as using reputable exchanges, implementing multi-factor authentication, and storing assets in secure hardware wallets.

5. Lending

Cryptocurrency lending operates on the principle of peer-to-peer lending, where lenders and borrowers interact directly through online platforms. Lenders deposit their digital assets into lending platforms, which then match them with borrowers seeking to borrow cryptocurrencies for various purposes, such as margin trading, short selling, or funding business ventures.

Lenders earn interest on their deposited assets based on predetermined interest rates and loan terms set by lending platforms. Interest rates may vary depending on factors such as supply and demand dynamics, borrower creditworthiness, and market conditions. Lenders have the flexibility to choose lending options that align with their risk tolerance and investment objectives.

To mitigate the risk of default, many cryptocurrency lending platforms require borrowers to provide collateral in the form of other cryptocurrencies or fiat currencies. Collateralization helps protect lenders’ funds by providing a security buffer in case borrowers fail to repay their loans. Additionally, lending platforms employ risk management strategies such as credit scoring, loan-to-value ratios, and liquidation mechanisms to minimize the risk of loan defaults.

6. Earning Interest

Participating in yield farming protocols allows cryptocurrency holders to lend their digital assets to decentralized platforms in exchange for interest payments. Yield farming, also known as liquidity mining, involves providing liquidity to decentralized finance (DeFi) protocols. In return for providing liquidity, users receive rewards in the form of interest or governance tokens, which can be staked, traded, or used to participate in protocol governance.

7. Affiliate Programs

Engaging in cryptocurrency exchange affiliate programs offers individuals the opportunity to earn commissions by referring new users to trading platforms or exchanges. Affiliate programs typically provide referral links or promotional materials that affiliates can use to attract new users to the platform. By referring users who subsequently sign up and trade on the platform, affiliates earn commissions based on the trading volume generated by their referrals.

Key Considerations for Affiliate Programs

- Reputation and Reliability: Choose cryptocurrency exchanges with reputable and reliable affiliate programs, backed by transparent terms and conditions, timely commission payments, and responsive customer support.

- Commission Structure: Evaluate the commission structure offered by affiliate programs, including commission rates, payment methods, and potential bonuses or incentives for high-performing affiliates.

- Marketing Strategies: Employ effective marketing strategies to promote affiliate links and attract new users, such as content marketing, social media promotion, or community engagement.

8. ICOs

Initial Coin Offerings (ICOs) present investment opportunities for individuals to purchase tokens issued by emerging blockchain projects in exchange for cryptocurrency or fiat currency. ICOs allow projects to raise capital to fund development and operations while offering investors the potential for high returns on their investment.

However, you must exercise due diligence to differentiate legitimate projects from potential scams and evaluate the viability and potential risks of participating in ICOs.

9. Holding Bitcoin

Holding Bitcoin, colloquially known as “HODLing,” involves acquiring and retaining Bitcoin as a long-term investment strategy, with the expectation of realizing substantial returns over time. Bitcoin has emerged as a store of value and digital gold, attracting investors seeking to hedge against inflation, economic uncertainty, and fiat currency devaluation.

If you consider hodling Bitcoin, you should evaluate your risk tolerance and allocate only a portion of your investment portfolio to it due to volatility.

10. Bitcoin ETFs

Bitcoin exchange-traded funds (ETFs) provide traditional investors with a regulated and accessible avenue to gain exposure to the cryptocurrency market without directly owning or storing Bitcoin. Bitcoin ETFs track the price of Bitcoin and allow investors to buy and sell shares on traditional stock exchanges, offering liquidity, transparency, and regulatory oversight.

However, you should understand the limitations and risks associated with ETF investments, including tracking errors, management fees, and market volatility.

Key Considerations for Bitcoin ETF Investments

- Regulatory Approval: Verify the regulatory approval and compliance status of Bitcoin ETFs in your jurisdiction, as regulatory frameworks may vary across different countries and regions.

- Tracking Methodology: Understand the tracking methodology employed by Bitcoin ETFs to ensure accurate representation of Bitcoin’s price movements. Evaluate factors such as tracking error, liquidity, and market depth when selecting ETF products.

- Costs and Fees: Assess the costs and fees associated with Bitcoin ETF investments, including management fees, expense ratios, and trading commissions. Compare different ETF products to identify cost-effective options that align with your investment objectives.

11. Credit Card Rewards

Credit card rewards programs offer an opportunity for individuals to earn rewards in Bitcoin or other cryptocurrencies based on their everyday spending. Crypto credit cards function similarly to traditional cash-back credit cards, allowing users to earn a percentage of their purchases in cryptocurrency rewards.

Be aware of transaction fees, exchange rates, and reward redemption options when using crypto credit cards.

12. Accepting Payments in Bitcoin

Integrate Bitcoin payment options for goods or services to attract a broader customer base and accumulate digital assets. Navigate tax implications and select reliable payment processors for seamless transactions.

Integrating Bitcoin payment options for goods or services allows businesses to attract a broader customer base and accumulate digital assets. By accepting Bitcoin payments, businesses tap into the growing cryptocurrency ecosystem, offer customers alternative payment methods, and position themselves as innovative and forward-thinking.

FAQs

-

Is cryptocurrency investing profitable?

Cryptocurrency investing can be profitable, but it carries inherent risks due to market volatility. Success in trading requires a solid understanding of market trends, technical analysis, and risk management strategies.

-

How can I mitigate the risks associated with crypto investments?

Mitigate risks by diversifying your investment portfolio, conducting thorough research on projects and platforms, and exercising caution when engaging in high-risk activities such as ICOs or day trading.

-

Are there any tax implications associated with crypto earnings?

Yes, cryptocurrency earnings are subject to taxation in many jurisdictions. Consult with tax professionals or utilize crypto tax reporting tools to ensure compliance with relevant tax laws.

-

Can I start mining cryptocurrency with minimal investment?

While it’s technically possible to mine cryptocurrency with minimal investment, the profitability of mining depends on factors such as electricity costs, hardware requirements, and mining difficulty. Conduct thorough research and consider joining mining pools for increased earning potential.

-

How can I identify legitimate cryptocurrency projects from scams?

Legitimate cryptocurrency projects exhibit transparency, a clear roadmap, active community engagement, and reputable team members. Beware of red flags such as unrealistic promises, lack of transparency, and plagiarized whitepapers, which may indicate potential scams.