You can make money with forex trading but requires understanding the market, applying the right strategy, and proper risk management.

This comprehensive guide offers valuable insights on how to make money trading forex. It covers key aspects such as understanding forex trading, choosing strategies, analyzing charts, managing risk, and closing trades.

It also addresses common trading questions, providing clarity on learning duration, profitability, trading hours, leverage, and account size requirements. By following this guide, traders can enhance their understanding, refine their approach, and increase their chances of success in the forex market.

Key Takeaways

- Understand forex trading fundamentals.

- Choose suitable trading strategies.

- Analyze charts and identify entry points.

- Manage risk effectively with stop-loss orders.

- Utilize take-profit orders to lock in profits.

- Address common FAQs for clarity and guidance.

How Does Forex Trading Work?

Forex trading involves speculating on currency price movements. Currencies are traded in pairs, with values influenced by economic factors and geopolitical events. Forex trading is like a global marketplace where people trade currencies from different countries.

Imagine you’re going on a trip to Europe from the United States. You’ll need to exchange your dollars for euros to buy things there. Forex trading is similar, but instead of exchanging money for your trip, you’re buying and selling currencies to make a profit.

Currencies are always traded in pairs, like EUR/USD or GBP/JPY. Each pair has two currencies: a base currency and a quote currency. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency.

The value of currencies changes all the time because of economic factors and events happening around the world. For instance, if a country’s economy is doing well, its currency might become stronger compared to others. Traders in the forex market try to predict these changes and make trades to profit from them.

Let’s say you believe that the euro will increase in value compared to the US dollar. You would buy the EUR/USD pair, hoping to sell it later at a higher price and make a profit. On the other hand, if you think the euro will decrease in value, you would sell the pair, aiming to buy it back later at a lower price.

Buying and Selling Currency Explained

In forex trading, currencies are traded in pairs, and each pair has two currencies: a base currency and a quote currency. Understanding these concepts is crucial for successful trading.

Here’s a visual representation of how currency pairs are quoted:

In this example, the exchange rate for the EUR/USD pair is quoted as 1.07842, indicating that 1 euro is equal to 1.07842 US dollars. Buying and selling currency pairs in forex trading involves understanding the relationship between the base and quote currencies and predicting how their values will change over time.

Let’s explain buying and selling of currencies with an example:

Imagine you’re trading the EUR/USD pair. In this pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. When you see the price of the EUR/USD pair quoted as 1.05007, it means that 1 euro is equivalent to 1.05007 US dollars.

Now, let’s say you believe that the euro will strengthen against the dollar, so you decide to buy the EUR/USD pair. You’re essentially buying euros with dollars. If the exchange rate goes up to 1.07560, it means that the euro has increased in value compared to the dollar. You can then sell the euros back for more dollars, making a profit.

On the other hand, if you think the euro will weaken against the dollar, you would sell the EUR/USD pair. In this case, you’re selling euros and buying dollars. If you sell the EUR/USD pair at 1.10361, and the exchange rate drops to 1.07808, it means that the euro has decreased in value relative to the dollar. Thereby, you make a profit.

Understanding base and quote currencies helps traders make informed decisions about when to buy or sell a currency pair. It’s essential to keep track of economic indicators, news events, and geopolitical factors that can influence currency values.

How Do You Make Money Trading Currencies?

Successful forex trading entails selecting appropriate strategies, analyzing charts, managing risks, and executing trades effectively. Executing trades effectively involves managing risk and closing trades strategically.

-

Choose Your Forex Trading Strategy

Success in forex trading requires more than just luck. It demands a solid understanding of various trading strategies. There are two main strategies forex traders employ to trade the market: fundamental analysis strategy and technical analysis strategy.

Fundamental Analysis Strategy

Fundamental analysis involves evaluating economic indicators, geopolitical events, and central bank policies to anticipate currency movements. Key factors include interest rates, GDP growth, inflation rates, employment data, and political stability.

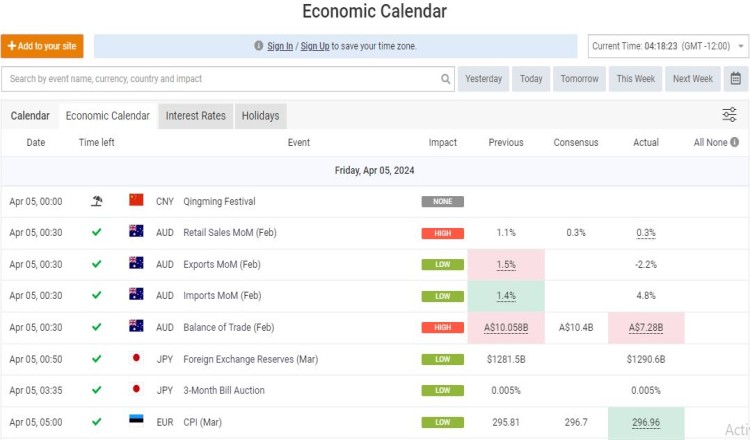

Traders analyze news releases and economic calendars to make informed trading decisions based on fundamental factors.

An example of fundamental analysis strategy is the carry trade strategy. Carry trade involves borrowing a currency with a low-interest rate and investing in a currency with a higher interest rate to profit from the interest rate differential.

Technical Analysis Strategy

Technical analysis focuses on historical price data, chart patterns, and technical indicators to identify potential trading opportunities. Common technical indicators include moving averages, relative strength index (RSI), MACD (Moving Average Convergence Divergence), and Bollinger Bands.

Traders use chart patterns such as support and resistance levels, trendlines, and candlestick patterns to predict future price movements.

Below are different types of technical analysis strategies:

Trend Following Strategy

Trend following strategies aim to capitalize on sustained price movements in a particular direction. Traders identify trends using technical analysis tools and enter positions in the direction of the trend.

Techniques like moving average crossovers and trendline analysis help traders ride trends while implementing risk management strategies to minimize losses.

Range Trading Strategy

Range trading involves identifying price ranges where a currency pair consolidates within a defined support and resistance level. Traders buy at support and sell at resistance, aiming to profit from price oscillations within the range.

Finding range using oscillators and support/resistance levels help traders identify range-bound markets and execute trades accordingly.

Breakout Strategy

Breakout strategies involve entering trades when price breaks above or below a significant support or resistance level. Traders anticipate strong momentum moves following a breakout and aim to capitalize on the subsequent price movement.

Chart pattern breakouts, volatility breakouts, and momentum indicators assist traders in identifying breakout opportunities.

Scalping Strategy

Scalping is a high-frequency trading strategy that involves executing multiple trades within a short time frame to capitalize on small price movements. Traders aim to make quick profits by exploiting temporary imbalances in supply and demand.

Scalping requires fast execution, tight spreads, and strict risk management to mitigate losses.

-

Analyze the Chart and Open a Position

Analyzing charts is a fundamental aspect of forex trading, helping traders identify potential entry and exit points for their positions. Traders can enter a position using two primary methods of analysis: technical analysis and fundamental analysis.

Analyzing the chart using technical analysis

For example, a trader may use the moving average crossover strategy, where they observe the intersection of short-term and long-term moving averages to signal potential entry or exit points. If the short-term moving average crosses above the long-term moving average, it may indicate a bullish trend and a signal to open a long position.

Analyzing the chart using fundamental analysis

For instance, if a country’s central bank announces an interest rate hike, it may attract foreign investment and strengthen the country’s currency. Traders may seize this opportunity to open a long position on that currency pair, anticipating further appreciation.

Combining Technical and Fundamental Analysis

Many traders use a combination of technical and fundamental analysis to make informed trading decisions. By integrating both approaches, traders can gain a comprehensive understanding of market dynamics and increase the probability of successful trades.

Example Trade Scenario: Let’s consider a trader who wants to open a long position on the EUR/USD pair. They perform technical analysis and notice that the pair has broken above a key resistance level, signaling a potential bullish trend. Additionally, they analyze fundamental factors and observe positive economic data from the Eurozone, suggesting a strengthening euro.

Based on this analysis, the trader decides to open a long position on EUR/USD, betting on the euro’s strength against the dollar.

-

Manage Your Risk

Risk management is a crucial aspect of forex trading that helps traders protect their capital and minimize potential losses. Implementing effective risk management techniques, such as stop-loss orders, is essential for navigating the volatile forex market.

Stop-Loss Orders

A stop-loss order is a predefined price level set by a trader to automatically close a position if the market moves against them. It acts as a safety net, limiting losses and preventing emotional decision-making during adverse market conditions.

For example, suppose a trader opens a long position on the EUR/USD pair at 1.0600. To manage their risk, they set a stop-loss order at 1.0500. If the market moves downward and reaches 1.0500, the stop-loss order will trigger, automatically closing the position and limiting the loss to 100 pips.

Position Sizing

Position sizing refers to determining the appropriate amount of capital to risk on each trade based on risk tolerance and account size. By calculating position sizes relative to stop-loss levels, traders can control the amount of capital at risk per trade and avoid overexposure.

For instance, a trader with a $10,000 trading account and a risk tolerance of 1% per trade would risk $100 on each trade. If the stop-loss for a particular trade is set at 50 pips, the trader would calculate the position size to ensure that a 50-pip loss equates to $100.

Diversification

Diversification involves spreading risk across multiple currency pairs or asset classes to reduce overall portfolio risk. By diversifying their trading portfolio, traders can mitigate the impact of adverse movements in any single market or instrument.

For example, instead of solely trading the EUR/USD pair, a trader may also trade other major currency pairs, such as GBP/USD or USD/JPY, as well as minor or exotic currency pairs, commodities, or indices.

-

Close the Trade

Closing a trade at the right time is essential for realizing profits and managing risk effectively in forex trading. Traders often use take-profit orders to automatically close positions when the market reaches a predefined level of profit.

Take-Profit Orders

A take-profit order is a predetermined price level set by a trader to automatically close a position and lock in profits when the market reaches that level. It allows traders to capitalize on favorable price movements without the need for constant monitoring.

For example, suppose a trader opens a long position on the EUR/USD pair at 1.0600. To secure profits, they set a take-profit order at 1.1000. If the market reaches 1.1000, the take-profit order will trigger, closing the position and locking in the profit of 400 pips.

Trailing Stop

A trailing stop is a dynamic stop-loss order that adjusts automatically as the market price moves in favor of the trade. It allows traders to capture profits while also protecting against potential reversals.

For instance, if a trader sets a trailing stop of 50 pips on a long EUR/USD position, and the market price increases by 50 pips, the trailing stop will move 50 pips higher. If the market then retraces by 30 pips, the trailing stop will remain at its highest level, locking in a profit of 20 pips.

Manual Closure

In some cases, traders may opt to manually close a trade based on their analysis of market conditions and price movements. This approach allows for more flexibility and discretion, particularly in volatile or fast-moving markets.

For example, if a trader observes signs of potential market reversal or reaches their predetermined profit target based on technical or fundamental analysis, they may choose to manually close the trade to secure profits.

FAQs

Is forex a good way to make money?

Forex trading offers the potential to make money, but it also carries significant risks. Success and profitability in forex trading depends on the trader’s ability to develop and execute a profitable strategy consistently.

Statistics show that only about 5-10% of retail forex traders manage to achieve long-term profitability. Therefore, while forex trading can be lucrative for a minority of skilled traders, it is not a guaranteed way to make money for the majority of participants.

How much do forex traders make a day?

Many successful and skilled traders aim for a daily profit target of around 1% of their trading capital, which could translate to hundreds or even thousands of dollars per day. The daily earnings of forex traders vary widely depending on their experience, trading style, and market conditions.

Beginner traders often struggle to achieve consistent profitability and may even incur losses on some days. On the other hand, experienced traders with proven strategies and risk management techniques can earn significant profits per trade.

Additionally, professional forex traders working for major financial institutions typically earn annual salaries averaging around $80,000. This is supplemented by performance-related bonuses based on trading performance and market-making activities.

How long does it take to learn forex?

It takes between 6-12 months to effectively learn forex trading basics to make money.

Learning forex varies depending on individual background and commitment. While grasping the basics can take weeks to months, mastering advanced strategies and analysis may require years of practice.

For instance, becoming proficient in technical analysis might take several months of consistent study and application. However, having a skilled mentor can significantly accelerate the learning process, potentially cutting the learning curve by half or more.

What percentage of forex traders are profitable?

Studies suggest that approximately 5-10% of retail forex traders consistently achieve profitability over the long term.

The vast majority of retail traders struggle to overcome the challenges of the forex market, including high volatility, complex market dynamics, and emotional biases. Successful traders often possess a combination of technical skills, discipline, risk management, and psychological resilience.

Can I start forex trading with a small amount of capital?

Yes, many forex brokers allow traders to open accounts with as little as $10 or even less. However, starting with a small amount of capital poses challenges, as it may limit the trader’s ability to diversify their trades and withstand market fluctuations.

Additionally, trading with a small account size may require higher leverage, which increases the risk of substantial losses. It’s essential for traders to carefully manage their risk and consider gradually increasing their capital as they gain experience and confidence in their trading strategy.

What is the average leverage offered by forex brokers?

Forex brokers typically offer leverage ratios ranging from 1:50 to 1:2000, although the exact leverage available may vary depending on the broker and the trader’s account type.

For example, a leverage ratio of 1:100 means that for every $1 in the trader’s account, they can control $100 in the forex market. However, it’s important to note that higher leverage also increases the potential for both profits and losses, and traders should exercise caution when utilizing leverage.

What are the typical trading hours for the forex market?

The forex market operates 24 hours a day, five days a week, starting from 5:00 PM EST (10 :00 PM GMT+1) on Sunday and closing at 5:00 PM EST (10 :00 PM GMT+1) on Friday. This extended trading schedule allows traders to participate in the market at their convenience, regardless of their time zone.