Forex trading in Nigeria has experienced significant growth in recent years, becoming a popular avenue for individuals seeking financial independence and wealth creation. With its accessibility, potential for profit, and flexible nature, forex trading has garnered the attention of Nigerians from all walks of life. This ranges from seasoned investors to beginners looking to enter the foreign exchange (forex) financial markets.

This comprehensive tutorial on forex trading in Nigeria discusses the fundamentals of forex trading, exploring the intricacies of currency pairs, the steps to start trading, various trading strategies, and available trading platforms. As well as the advantages, risks, and best practices associated with forex trading in Nigeria.

Whether you’re a newcomer eager to learn the ropes or a seasoned trader seeking to refine your skills, this article aims to equip you with the knowledge and insights needed to trade the forex market effectively in Nigeria.

What is Forex Trading, and How Does it Work?

Forex trading, short for foreign exchange trading, involves the buying and selling of currencies on the global foreign exchange market. Traders aim to profit from fluctuations in currency exchange rates by speculating on whether a currency will strengthen or weaken against another. This decentralized market operates 24 hours a day, five days a week, and is the largest financial market in the world by trading volume.

Participants in forex trading include individual retail traders, institutional investors, corporations, banks, and central banks. Forex trading offers opportunities for profit through leverage, allowing traders to control large positions with a relatively small amount of capital.

However, it also carries significant risks, including the potential for substantial losses. Successful forex trading requires a solid understanding of market fundamentals, technical analysis, risk management, and discipline.

Is forex trading legal in Nigeria?

Yes, forex trading is legal in Nigeria. However, traders must conduct their activities through regulated brokers and adhere to relevant financial regulations.

Understanding Currency Pairs

Currency pairs are expressed in two currencies, known as the base currency and the quote currency. For example, in the EUR/USD currency pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency.

The base currency indicates how much of the quote currency is needed to purchase one unit of the base currency. In the EUR/USD pair, if the exchange rate is 1.07842, it means 1 euro can be exchanged for 1.07842 US dollars.

Types of Currency Pairs

Currency pairs are categorized into three main types: major, minor, and exotic pairs.

Major currency pairs consist of the most traded currencies globally, including the US dollar (USD). Examples of major currency pairs are EUR/USD, GBP/USD, and USD/JPY.

Minor currency pairs, also known as cross-currency pairs, do not include the US dollar. Examples include EUR/GBP, GBP/JPY, and AUD/NZD.

Exotic currency pairs involve one major currency and one currency from a developing or emerging market. Examples are USD/TRY (US dollar vs. Turkish lira) or EUR/ZAR (euro vs. South African rand).

Currency Pairs Lingo

Below are forex terms relating to currency pairs.

- The base currency indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

- Bid price refers to the price at which the market is willing to buy the base currency.

- Ask price, on the other hand, is the price at which the market is willing to sell the base currency.

- The spread is the difference between the bid and ask prices. For instance, if the EUR/USD pair has a bid price of 1.1200 and an ask price of 1.1205, the spread is 5 pips.

- Pip stands for “percentage in point” or “price interest point” and represents the smallest price move in the forex market. In most currency pairs, a pip is equivalent to 0.0001, except for pairs involving the Japanese yen, where it is 0.01.

What factors influence currency prices in the forex market?

Currency prices are influenced by various factors, including economic indicators, central bank policies, geopolitical events, and market sentiment.

How to Start Forex Trading in Nigeria?

Forex trading in Nigeria presents a lucrative opportunity for individuals seeking financial independence and flexibility. However, diving into the forex market requires careful preparation and understanding of its intricacies.

Here’s a step-by-step guide on start forex trading in Nigeria:

Step 1: Learn Forex Trading

Before venturing into live trading, it’s essential to acquire a solid understanding of the forex market and its dynamics. Learning the basics will provide a solid foundation for making informed trading decisions.

How to Learn Forex Trading in Nigeria?

-

Enroll under a Forex Tutor or Take Online Trading Courses

Seek reputable forex tutors or enroll in online courses offered by established institutions such as Apex Traders Academy. Our forex trading resources cover essential topics such as technical analysis, fundamental analysis, risk management, and trading psychology.

-

Understand Common Forex Terminology

Familiarize yourself with key forex terms like pip (percentage in point), spread, leverage, margin, and more. Understanding these terms is crucial for interpreting market movements and executing trades effectively.

-

Practice on a Forex Demo Account

Practice makes perfect, and demo accounts provide a risk-free environment for honing your trading skills. Most brokers offer demo accounts with virtual funds, allowing you to simulate real-market conditions without risking your capital.

Step 2: Choose a Regulated Forex Broker

Selecting the right forex broker is paramount to your trading success. Ensure the broker is regulated by reputable authorities such as the Securities and Exchange Commission (SEC) in Nigeria. Regulation helps protect traders’ funds and ensures fair trading practices.

Here are top reputable forex brokers in Nigeria along with their user ratings:

- Exness– Overall Best Forex Broker in Nigeria (User Rating: 4.8/5)

- HotForex (HFM)– Best Forex Broker for Beginners (User Rating: 4.6/5)

- FXTM– Best Forex Broker for Naira CFDs on USD/NGN & EUR/NGN (User Rating: 4.7/5)

- XM Broker– Best Forex Broker for Spread Only Trading Account (User Rating: 4.5/5)

- AvaTrade– Best Forex Broker for Fixed Spreads (User Rating: 4.7/5)

- OctaFX– Good Forex Broker with Local Funding Options in Nigeria (User Rating: 4.6/5)

- FxPro– Best Forex Broker with Multiple Platforms at Low Cost (User Rating: 4.8/5)

- Tickmill– Best Regulated Forex Broker with Pro Accounts (User Rating: 4.7/5)

- IC Markets– ASIC Regulated Forex Broker (User Rating: 4.6/5)

- PepperStone– Forex Broker with Commissions (User Rating: 4.5/5)

These brokers have established themselves in the Nigerian market and have garnered positive feedback from users. The ratings are based on user reviews, platform features, customer support, and overall trading experience.

How can I choose a reliable forex broker in Nigeria?

Look for brokers regulated by reputable authorities like the Securities and Exchange Commission (SEC) in Nigeria. Consider factors such as trading platforms, customer support, and trading conditions.

Step 3: Open a Forex Trading Account by Completing Your KYC

Start with Demo Accounts

Begin your trading journey by opening a demo account with your chosen broker. Demo accounts replicate live market conditions, enabling you to practice trading strategies and familiarize yourself with the trading platform.

What are the benefits of using a demo account for forex trading?

Demo accounts allow traders to practice trading strategies and familiarize themselves with the trading platform without risking real money. It’s an essential tool for beginner traders to gain experience.

Open a Live Account

Once you’ve gained confidence and proficiency in demo trading, consider opening a live trading account. Live accounts require real capital, so ensure you’re financially prepared and adhere to proper risk management practices.

Step 4: Download Trading Platform from Broker’s Website

After opening an account, download the trading platform provided by your broker. Choose a platform that aligns with your trading preferences and offers essential features like charting tools, technical indicators, and order execution capabilities.

Step 5: Fund Your Trading Account via Local Payment Methods

Depositing funds into your trading account should be seamless and convenient. Opt for brokers that support local payment methods popular in Nigeria, such as bank transfers, online payment systems, or mobile money platforms.

How much money do I need to start forex trading in Nigeria?

The amount required to start forex trading varies depending on the broker and trading account type. Some brokers such as Exness offer accounts with minimum deposits as low as $1, while others like ICMarkets require larger initial investments of $200.

Can I trade live without my own capital?

Yes, you can trade the live market without your own capital through establishing an hedge fund or trade through proprietary trading firms, known as prop firms. A hedge fund is an investment vehicle that pools funds from investors and employs various investment strategies to generate returns. While prop firms provide traders with capital to trade in exchange for a portion of the profits.

Step 6: Place Your Trades from the Platform

With your account funded and trading platform installed, you’re ready to start placing trades. Utilize different order types, including market orders, limit orders, and stop orders, to execute your trading strategies effectively.

Step 7: Manage the Trade

Once a trade is opened, actively manage it by monitoring market conditions and adjusting your stop-loss and take-profit levels accordingly. Implementing proper risk management techniques is essential to protect your capital and maximize profits.

Step 8: Close the Trade

Know when to exit a trade based on your predetermined trading plan and market analysis. Closing a trade at the right time can lock in profits or minimize losses, contributing to long-term trading success.

Trading Opportunities Through Proprietary Trading Firms in Nigeria

In recent years, trading has expanded rapidly, offering numerous avenues for individuals to participate in financial markets and potentially generate profits. One such avenue gaining traction globally, including in Nigeria, is trading through proprietary trading firms.

Proprietary trading firms, also known as prop firms, are entities that provide traders with capital to trade in financial markets. These firms offer an alternative for individuals who may not have significant personal capital to invest but possess the skills and knowledge to excel in trading. In Nigeria, the concept of proprietary trading firms is gradually gaining popularity, providing opportunities for aspiring traders to enter the financial markets.

One of the primary advantages of trading through proprietary firms is access to substantial capital. Typically, these firms allocate trading capital to qualified traders based on their performance and trading strategies. This enables traders to leverage larger positions and potentially amplify their returns compared to trading with their own limited capital.

Moreover, proprietary trading firms often provide advanced trading platforms, sophisticated analytics tools, and comprehensive training programs to support traders in their endeavors. These resources empower traders to execute their strategies effectively and stay competitive in dynamic market environments.

In Nigeria, proprietary trading firms offer an avenue for individuals to participate in various financial markets, including stocks, forex, commodities, and cryptocurrencies. This diversification allows traders to explore different asset classes and capitalize on emerging opportunities across global markets.

However, it’s essential to recognize that trading through proprietary firms involves inherent risks. While traders have access to increased capital and resources, they must adhere to strict risk management principles to protect both their own and the firm’s capital. Additionally, traders may be subject to performance targets and risk limits imposed by the firm, necessitating discipline and accountability in their trading activities.

What are the best prop firms I can trade with?

- FTMO

- The Funded Trader

- Fidelcrest

- TopStepTrader

- NextStepFunded

Forex Trading Strategies

Forex trading strategies are essential tools that traders use to make informed decisions and maximize profits in the currency market. These strategies can broadly be categorized into fundamental analysis and technical analysis, each offering unique insights into market dynamics.

Let’s discuss these two main strategies:

Fundamental Analysis

Fundamental analysis involves evaluating economic, social, and political factors that influence currency values. Traders analyze economic indicators, central bank policies, and geopolitical events to gauge a currency’s strength or weakness.

Fundamental Analysis Strategies

- Interest Rates:Changes in interest rates set by central banks affect currency values. Higher interest rates attract foreign capital, leading to currency appreciation.

- GDP (Gross Domestic Product):GDP measures the economic health of a country. Strong GDP growth typically strengthens the currency, reflecting a robust economy.

- Inflation:Rising inflation erodes purchasing power, leading to currency depreciation. Central banks may raise interest rates to combat inflation, which can support the currency.

- Geopolitical Events:Political instability, wars, and trade disputes can impact currency values. Traders monitor geopolitical developments to anticipate market reactions.

Technical Analysis

Technical analysis involves studying historical price data and identifying patterns to predict future price movements. Traders use various technical indicators and chart patterns to analyze market trends and make trading decisions.

Technical Analysis Strategies

- Moving Averages: Moving averages smooth out price data, helping traders identify trends and reversals. Common types include simple moving averages (SMA) and exponential moving averages (EMA).

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to determine overbought or oversold conditions. Traders use RSI to identify potential trend reversals.

- MACD (Moving Average Convergence Divergence): MACD combines two moving averages to identify trend direction and momentum. Crossovers and divergence signals provide buy or sell opportunities.

- Fibonacci Retracement Levels: Fibonacci retracement levels indicate potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to identify entry and exit points.

What are the differences between fundamental and technical analysis in forex trading?

Fundamental analysis involves evaluating economic indicators and news events to forecast currency movements, while technical analysis focuses on studying price charts and patterns to identify trading opportunities.

Forex Trading Platforms in Nigeria

Forex trading platforms serve as the gateway for traders to access the forex market, execute trades, and analyze market data. In Nigeria, several platforms cater to the needs of traders, offering various features and functionalities to enhance trading experience.

Some of the popular forex trading platforms used in Nigeria include:

MetaTrader 4 (MT4)

MetaTrader 4, or MT4, is one of the most widely used forex trading platforms globally, known for its user-friendly interface and powerful analytical tools. It offers a comprehensive suite of features, including customizable charts, technical indicators, and automated trading capabilities through Expert Advisors (EAs).

Traders in Nigeria prefer MT4 for its reliability, extensive charting capabilities, and compatibility with a wide range of devices, including desktop computers, smartphones, and tablets. Additionally, MT4 supports multiple order types, allowing traders to execute various trading strategies with ease.

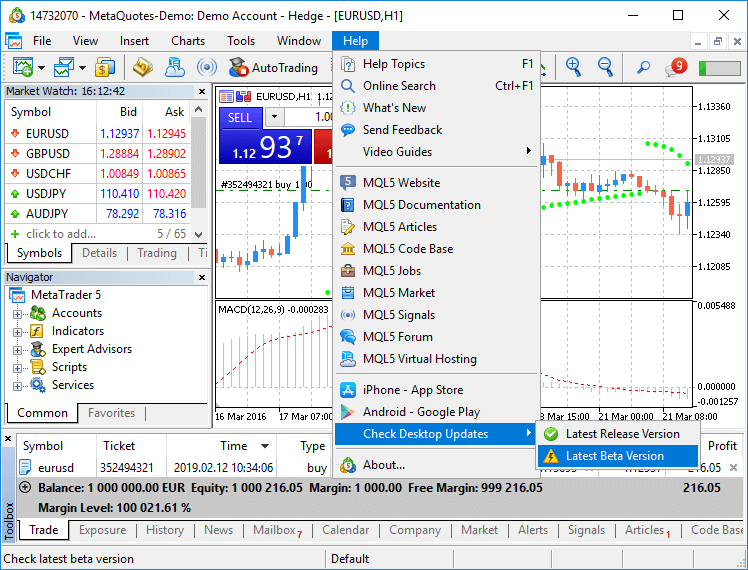

MetaTrader 5 (MT5)

MetaTrader 5, the successor to MT4, offers enhanced features and functionalities designed to meet the evolving needs of traders. While MT5 retains many of the features of its predecessor, it introduces additional asset classes, including stocks and commodities, expanding trading opportunities for Nigerian traders.

MT5 boasts advanced technical analysis tools, improved charting capabilities, and an integrated economic calendar to keep traders informed about market-moving events. Moreover, MT5 supports hedging, allowing traders to open multiple positions in the same instrument simultaneously.

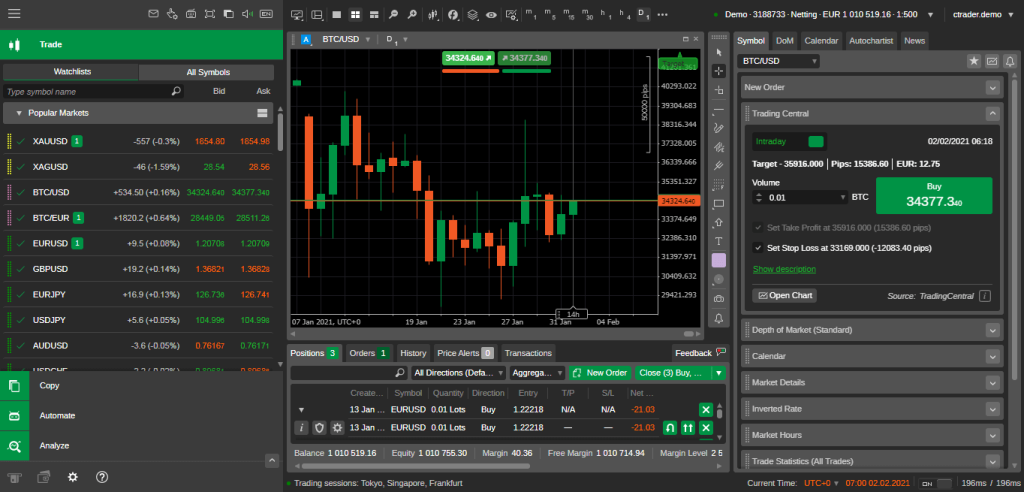

cTrader

cTrader is another popular forex trading platform known for its intuitive interface and advanced trading capabilities. It offers a clean and user-friendly layout, making it ideal for both novice and experienced traders. cTrader provides access to a wide range of financial instruments, including forex, indices, and commodities, allowing traders to diversify their portfolios.

One of the standout features of cTrader is its innovative charting package, which includes a wide range of technical indicators and drawing tools for comprehensive market analysis. Additionally, cTrader offers transparent pricing and fast execution speeds, ensuring optimal trading conditions for Nigerian traders.

Advantages & Risks of Forex Trading

Forex trading presents both opportunities and risks for traders in Nigeria. Understanding these factors is essential for making informed trading decisions and managing potential outcomes effectively.

Advantages of Forex Trading

- High Liquidity: The forex market is the most liquid financial market globally, with trillions of dollars traded daily. This high liquidity ensures that traders can enter and exit positions quickly without significant price slippage.

- 24-Hour Trading: Unlike other financial markets, such as the stock market, the forex market operates 24 hours a day, five days a week. This extended trading hours allow traders in Nigeria to participate in the market at their convenience, regardless of their time zone.

- Potential for Profit: Forex trading offers the potential for substantial profits, thanks to the volatility of currency prices. Traders can capitalize on price movements by buying low and selling high, or selling high and buying low, depending on market conditions.

- Accessibility: With the advent of online trading platforms and mobile apps, forex trading has become more accessible to retail traders in Nigeria. All that’s needed is a computer or smartphone and an internet connection to start trading.

- Diversification: Forex trading allows traders to diversify their investment portfolios by trading various currency pairs. This diversification can help spread risk and reduce exposure to any single asset or market.

Risks of Forex Trading

- Leverage Risk: Forex trading often involves the use of leverage, which allows traders to control positions larger than their capital. While leverage can amplify profits, it also magnifies losses, increasing the risk of significant financial loss.

- Market Volatility: The forex market is inherently volatile, with prices fluctuating rapidly in response to economic news, geopolitical events, and other factors. High volatility can lead to unpredictable price movements, increasing the likelihood of losses.

- Lack of Regulation: While forex trading is regulated in many countries, including Nigeria, there are still instances of unregulated brokers and fraudulent schemes targeting unsuspecting traders. It’s crucial for traders to conduct thorough research and choose reputable brokers to mitigate this risk.

- Psychological Factors: Successful forex trading requires discipline, patience, and emotional control. Traders may fall victim to psychological biases, such as fear and greed, which can cloud judgment and lead to impulsive decision-making.

- Overtrading: Inexperienced traders may succumb to the temptation of overtrading, placing too many trades in pursuit of quick profits. Overtrading can lead to exhaustion, increased transaction costs, and diminished returns.

What are the common mistakes to avoid in forex trading?

Common mistakes include overleveraging, emotional trading, lack of risk management, and neglecting to use stop-loss orders. Traders should develop a disciplined approach to trading and continuously learn from their experiences.

Opening and Closing Time for Forex Markets in Nigeria

Forex trading in Nigeria offers flexibility due to its 24-hour nature, allowing traders to participate in the market at various times. But retail traders can only access the market and trade the hours between Sunday 10:00 PM and Friday at 10:00 PM. Knowing the opening and closing times of different market sessions is crucial for maximizing trading opportunities and managing risk effectively.

Forex Market Sessions and Trading Hours

The forex market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. We can also classify the trading sessions on the basis of region: Asian Session, European Session, and North American. Each session has its own unique characteristics and trading hours, influenced by the major financial centers located within the respective regions.

-

Asian Session

- Opening Time: The Asian session typically begins at 01:00 PM GMT+1 and ends at 10:00 AM GMT+1.

- Major Financial Centers: Tokyo, Singapore, Hong Kong.

- Characteristics: The Asian session is known for relatively low volatility compared to other sessions. However, currency pairs involving the Japanese yen (JPY) may experience increased activity during this time due to market participants in Japan.

-

European Session

- Opening Time: The European session commences at 8:00 AM GMT+1 and concludes at 5:00 PM GMT+1.

- Major Financial Centers: London, Frankfurt, Zurich.

- Characteristics: The European session is the most active session in terms of trading volume and volatility. It overlaps with the Asian session for a few hours, leading to increased liquidity.

-

North American Session

- Opening Time: The North American session starts at 1:00 PM GMT+1 and ends at 10:00 PM GMT+1.

- Major Financial Centers: New York, Toronto, Chicago.

- Characteristics: The North American session experiences high volatility, especially during the overlap with the European session. Economic data releases from the United States can significantly impact currency prices.

What are the Forex Market Trading Hours?

| Market Session | Trading Hours (GMT+1) |

| Sydney | 10:00 pm to 7:00 am |

| Tokyo | 01:00 am to 10:00 am |

| London | 08:00 am to 05:00 pm |

| New York | 01:00 pm to 10:00 pm |

What is the Best Time to Trade Forex in Nigeria?

The best time to trade forex in Nigeria depends on various factors, including trading style, currency pairs traded, and personal schedule. However, there are certain times when trading activity and volatility are heightened, presenting more opportunities for traders.

- Overlap Periods: The overlap between different trading sessions, such as the London and New York sessions, often results in increased trading activity and liquidity. Traders in Nigeria may find this period conducive to executing trades due to higher volatility.

- Major Economic Releases: Economic data releases, such as non-farm payroll (NFP) reports and central bank announcements, can cause significant price movements in the forex market. Traders may consider trading during these times to capitalize on potential market volatility.

- Personal Schedule: As a trader in Nigeria, you should align your trading activities with their personal schedule and trading preferences. Some traders may prefer to trade during specific hours that coincide with their availability and optimal trading conditions.